Around Paying for (and Charging for) Content

No, this is not a signal of impending monetization of this newsletter; rather I want to talk about commerce around content (i.e., information) in general.

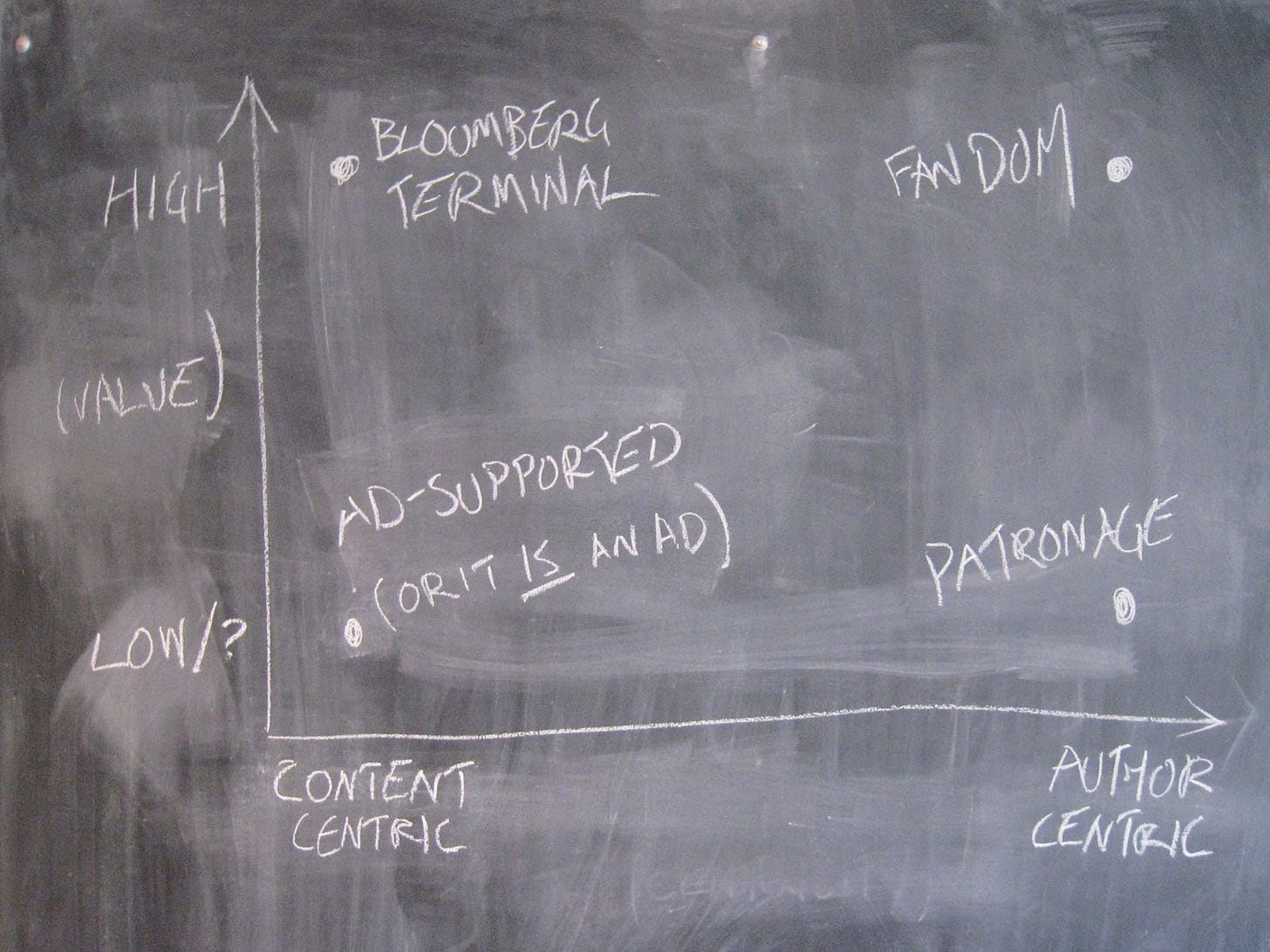

I have opinions about charging for content. They roughly reduce to: it should either be information you can use, or stark naked patronage. That is, you’re paying for the content because of what you can do with it (or rather, not do without it), or you’re paying for the content because it’s coming from me.

I draw my inspiration here mainly from Kevin Kelly’s infamous essay Better Than Free, which describes six distinctly operational properties of content worth paying for, plus patronage, plus interpretation, which is perhaps somewhere in between.

I don’t feel comfortable charging for this newsletter, for example—at least in its current state or incarnation—because I feel like the histogram of energy density, to the extent that you could draw one, doesn’t peak high enough in either bucket. As such, should I ever venture into any commercial offering of this sort, it will be more clearly one of these species or the other.

I also have Opinions™ about ad-supported content, that can be pronounced roughly like, it clearly can’t be that important if you’re actively trying to distract people away from it. Shout out to Australia trying to extort Facebook for linking to news articles nobody can be bothered to click on. Hopefully Canada doesn’t try something as dumb.

About the only ad-adjacent monetization I do support in principle, on account of their being generally unobtrusive, is affiliate links to products, which is ironic because it’s a violation of Amazon’s TOS for some reason to use affiliate tags in email. (I noticed Substack clips these tags off in the emailed version and initially accused them of sniping my revenue, but it turns out they’re actually doing me a favour by keeping me out of trouble with Amazon. So, sorry about that.)

(Underscoring in principle here: in practice, affiliate links are not a terrific deal.)

I am also somewhat concerned, as readers may be aware, of this platform-mediated content culture: if you subscribe (paid) to my Substack, and I subscribe to your Substack, we both net negative, and Substack earns two commissions. Umair Haque, who has gotten prickly in his old age, recently remarked something on the order of “tech companies making us beg each other for pennies” (a line he seems to use a lot, apparently), to which I add, “and take a cut every time.” There is of course nothing new about this—cough global financial system—my beef is that the cut they take is way too damn big for every extremely online person to pay their mortgage as a newsletter maven.

The Parable of the Platform Rant

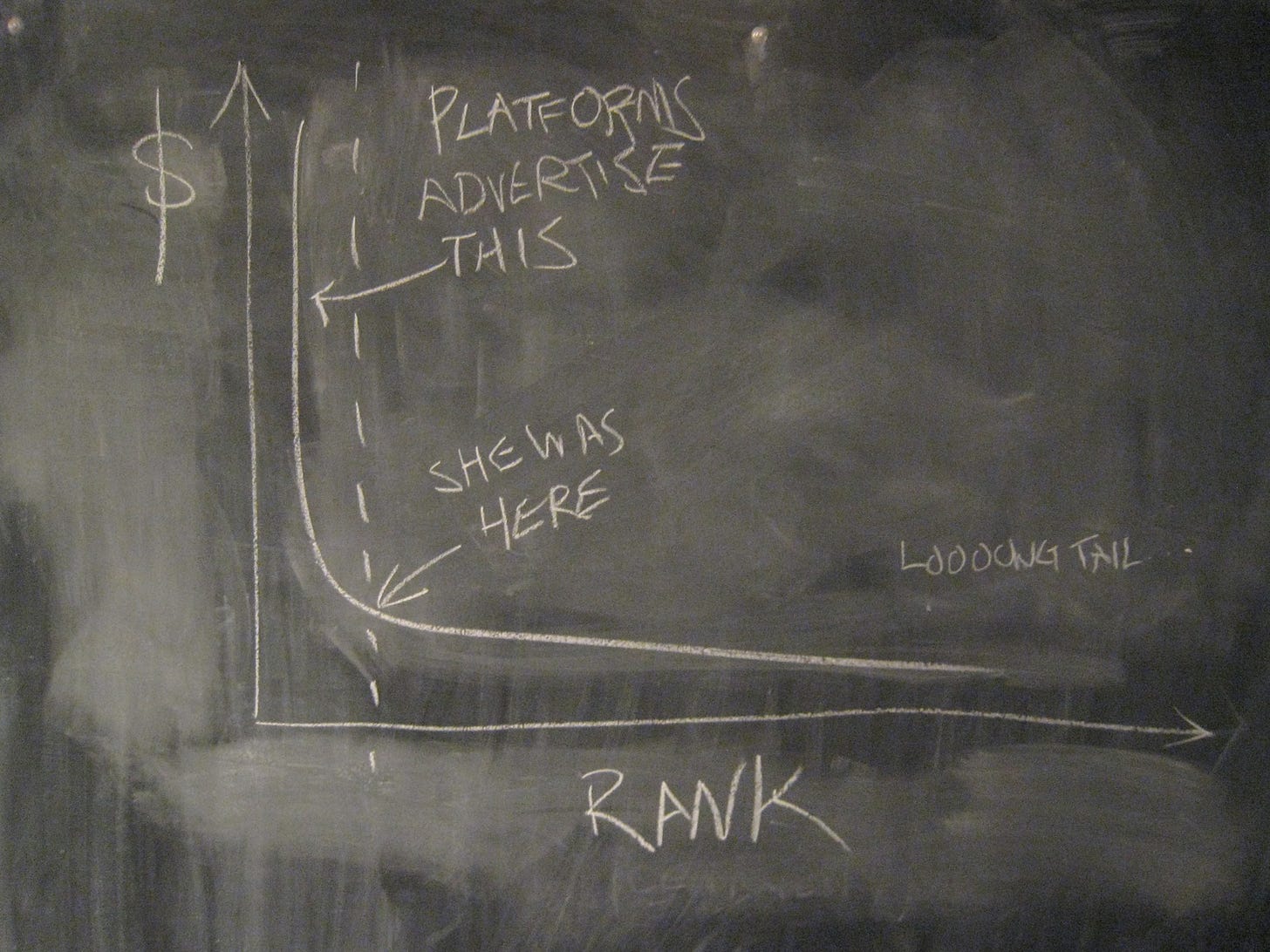

I had a tangential complaint about Etsy over a decade ago when my girlfriend at the time just could not get enough momentum as a seller: one good month excepted, her Etsy revenue never made it into the zone of a comfortable living. At the time, Etsy was publishing monthly stats such that it was possible to derive a global conversion rate (the ratio of sales to page views). We of course had her individual conversion rate, which tracked roughly with the global one—a little under 3%, or every 35 page views or so per item would result in a sale. Other enterprising individuals had put together leaderboards for sellers in different verticals. It was possible from there to estimate the revenue of the top sellers in hers—vintage clothing—and determine that she was roughly right in the kink of the curve, the butt-cheek of the proverbial Long Tail.

What that meant was there was no way, through having a better product or simply hard work (she already had great products and was working more than full-time), that her revenue was going to significantly improve. She would have to somehow disrupt one of the dozen or so—yes, the number in her vertical was that small at the time—people ahead of her.

To do that, she would need to either increase her conversion rate (unlikely, and raising prices would have heavily dented it), or get more traffic. Traffic would have to come from somewhere else, because it wasn’t coming from Etsy. The total number of page views they were able to command—which was, in their defense, a lot—simply did not commute to enough sales at or around her conversion rate. The obvious next step was ads through Google, but it would have cost her half of what she was earning to run a meaningful campaign. At that point it was worth asking what precisely Etsy was doing for her anyway, besides providing an e-commerce platform (a commodity service she now pays an appropriately commodity price for). When she got this information, she promptly quit the enterprise, only to resume under her own brand some years later.

She appears to be doing quite well in her new configuration (I was going to link you to her store, but she asked me not to). When I contacted her for this segment, she said she had actually gone back to Etsy for a while and done multiples better that time around. She has gotten more sophisticated, to be sure, though two items to note: a cursory glance at Etsy’s latest complete annual report suggests it has doubled in size several times since her first try, increasing the raw hits from which sales are derived, and image-heavy social media properties like Pinterest and Instagram—crucial tools for driving organic traffic—weren’t the juggernauts they are today (indeed, Pinterest was brand spanking new, and Instagram didn’t even exist yet).

The moral of this story goes something like, if we’re destined to live in power-law land, a platform is a caricature thereof. It’s a toy model—a closed system. There are very limited slots for people to earn a living through a given platform, let alone the lavish one they advertise to you to come join them (the very act of which further enriches the subject of the advertisement). This number is generally amenable to a back-of-the-envelope calculation from a few data points you can often get from Google, if not the platform itself.

Also note this is not me picking on Etsy; they’re just the only one I had a reason to scrutinize. This is going to be a property of all of these market-making platforms, though, from Uber to OnlyFans. The order sets in very quickly, and only a major disruption from outside the system will upset it. An interesting observation is that this phenomenon happens every time for every new domain name, and new ones show up every day. There has never been a better set of petri dishes for this kind of social dynamic.

A very interesting metric for these platforms to track—and if courageous, publish—would be α, the tail exponent of their monetization curve. Using that, a seller—or at least an analyst—could figure out where the ceiling was.

The Paradox of Information Services

The central paradox of information services—that is, services that provide some sort of infungible, idiomatic informational content—is that in order to sell your product, you have to give a lot of it away for free. Indeed, you have to pay quite a bit out of pocket (in hours and often dollars) to organize, curate, package, and place it. I recall Douglas Rushkoff, many years ago, regarding solicitations to him to give talks to promote his books, and then similar solicitations to write for free to promote himself as a speaker, remarking something on the order of “at what point is somebody actually going to pay me for any of this activity?”

How About Another Anecdote?

My brother, Brendan, has been earning his living for many years as an actor. It has been interesting to watch his career gain momentum.

Most recently, you can catch him playing the character Mutt on Firefly Lane, which I understand is doing very well right now on Netflix.

The ground game of the acting business, from what I have osmosed over the years, is a relatively well-defined stochastic process: assuming you have the training, and can control for your own ability not to burn your reputation or just plain suck, if you go to ten to fifteen auditions in a month, the odds are that you will get at least one job (the inventory is mainly TV commercials, with series and movies proportionately scarcer), and the proceeds of that job are such that you only need a handful like it a year. In other words, it’s a numbers game with three or four parameters, that within certain ranges create a viable performance envelope. Each audition costs roughly the same order of magnitude in terms of hours to prepare for, go to, and perform at. Despite the massive speculative overhead—15 auditions a month is pretty much a full-time job, after all—it’s the envelope of parameters that mean the gamble pays off on average.

Note that since COVID is now a thing, he just uses the bluescreen he has in his loft to record/Zoom his auditions. I should also note that I know somebody else who, at least until last year, literally paid the rent by winning triathlons. The dynamics of a stochastic income, where the earner is an individual, is worth some serious study.

Naturally, over time, as you build relationships and get your content out there, the slope of the hill inverts and the calls start rolling in to you. At the very least this influx of free work disencumbers you to go after the really desirable parts.

In what sense is acting an information service? In the sense that you are providing a unique performance for which, in the fine grain, there is no substitute. Except that every actor—or artist, or musician, or writer—spends a good chunk of their energy demonstrating why the coarse-grained distinction between them and the next one matters. What makes acting an interesting object of study is precisely this auditioning process with (again, relatively) well-defined costs and expected value.

I have been thinking for some time about how to model this process to my own work, but I find my work is too heterogeneous: somebody like my brother might spend 5-10 hours per audition, with a little less than a 1/10 chance of an average payout of, let’s say, 1-3 months of expenses. Moreover, the part of the process where he actually earns his money might take him a few days on average, whereas for me it might take months—although I don’t need as many gigs as he does (and he probably doesn’t either, now that he’s farther up the ladder).

This generalized auditioning process is begging to be modeled. From interviews for nine-to-fivers, to what my brother does, to what I do; the only difference is in the values of the parameters. Such a model would also be good for discovering which combinations of parameters are more or less viable for hypothetical setups.

One other item from the film industry I want to remark on, with respect to the “giving away” part of information services, is the trailer: the customarily two-minute advertisement for a movie or TV show that details why you should watch it. Trailers are extra work that, by their nature, can’t be done until most of the way through the project. They have to be edited and curated just right so they pique maximum hype without yielding any spoilers. It would behove us to figure out what the analogue of a trailer is for our respective professional domains.

The novelist K.M. Alexander uses his graphic design skills to make animated vignettes that he posts on Instagram, that render both the mood and the setting of his books.

Open-Source as Captured Offgassing

Like many others, I do two kinds of thing in the open-source ecosystem:

Original development,

Contributing to other people’s projects.

It is important to interrogate why I spend a considerable amount of my time on this enterprise. The answer is, roughly, because I want software that does what I want it to do, and none of what I don’t. Irrespective of whether it’s mine or somebody else’s. The central, often tacit compact of open-source contributions, after all, goes roughly like “I will invest my time improving your software if you agree to integrate my changes and maintain them.”

I wrote recently that open-source software development is at right angles to the money economy, and I meant it partially in the sense that while it is scarcely transacted directly as a work for hire, the worlds of what Fred Brooks calls✱ a “gift-for-prestige culture” and a “software-for-dollars culture” intersect at a junction, such that the latter often just glues together the former (and precisely how you glue the parts together is what gets paid for). Every tech megacorp depends heavily on open-source software and is ultimately parasitic on it, but we tolerate the parasitism to perhaps one day become a tech megacorp ourselves. Or something.

✱ In a keynote I often revisit for many reasons, not the least of which his truly remarkable and energizing tent-preacherly delivery.

In practice, I just write a lot of libraries. Every single one of them tells a story of a problem I myself had, that I solved for myself (or more distally, a client), and then packaged and published the result in case anybody else had that problem too. I don’t terribly care who uses it or even really know, so Brooks’ “gift-for-prestige” assessment may not actually apply to me, at least for my original work.

So, while you can leverage a high-profile project into (rarely more than) a high-paying job, I don’t know that’s ever been my motivation. The thing is, whether it’s my code or somebody else’s, I invariably need it for something. The open-source artifact is a byproduct, rather than a first-order product, with some very attractive properties, even if cash money isn’t one of them. It’s just one facet of the speculative work I have to do to win the job, which in turn earns the paycheque. My recent foray into streaming, which I began in order to help demystify my process, has similar contours: the first-order thing is something I have to do anyway; it doesn’t cost me much extra to turn the camera on.

The Future Is Speculative

Going forward, I suspect things are going to get more volatile, and COVID is just a taste. The climate is changing, Boomers aren’t retiring (and when they finally do, the Gen-Xers who replace them won’t be able to), full-time employment horizons have been shortening for decades, corporations themselves aren’t living as long, and so-called “tech” companies are arranging things so that we “beg each other for pennies” in under-the-algorithm sharecropping fiefs. Those pennies are gonna have to come from somewhere (and UBI, if it ever happens, won’t cover it). The difference is going to have to be mined from the gaps between the platforms. We’re all going to have to get used to dealing with more uncertainty: the age of the “sure thing”, to the extent that it ever existed, is over. So we might as well get good with a pickaxe.